If you smoke in Canada, you already know the sting at the till. Last time, we discussed how much a pack costs in Canada. With prices in the high teens, it’s no wonder that more people are asking:

“Where can I find the cheapest smokes in Canada?”

Truthfully, for many smokers, the lowest prices usually come from native smokes — cigarettes produced by Indigenous manufacturers on First Nations land — either on-reserve or through Indigenous-owned online shops. These products often avoid or reduce certain taxes, which is why they can be drastically cheaper than big-brand cigarettes sold at gas stations and convenience stores. Did you know that taxes make up a bulk of the price tag on cigarettes? If that doesn’t sound ideal to you, this guide will walk you through:

- What native smokes are and why they’re cheaper

- How on-reserve smoke shops work

- How Indigenous-owned online retailers operate

- How Cigarette Express fits into the landscape

- Legal and health considerations you shouldn’t ignore

Buckle up, and get ready to learn the life hack that so many Canadians have come to rely on.

A quick disclaimer

This guide is about pricing and access, not an endorsement of smoking. Native smokes carry the same health risks as any other cigarettes: cancer, heart disease, and lung disease, among many others. Lower cost doesn’t mean lower harm.

It’s also important to follow Canadian federal and provincial laws around tobacco, taxation, and importation, and to purchase only from reputable, legal sellers.

What Are Native Smokes?

Native smokes (also called reserve cigarettes or Indigenous cigarettes) are tobacco products:

- Produced by Indigenous-owned manufacturers

- Typically made on First Nations reserves

- Often sold through on-reserve shops or Indigenous-owned online stores

Under Section 87 of the Indian Act, registered First Nations individuals are exempt from certain federal and provincial taxes on goods purchased or produced on reserve, and that can include tobacco.

Because of this tax structure, native smokes:

- Often exclude some or all of the usual tobacco taxes

- Are sold through independent, Indigenous-controlled distribution networks

- Frequently sell at prices that are far below fully taxed retail brands

Despite a persistent myth that they’re “knock-offs,” many First Nations tobacco companies maintain strict manufacturing standards, using Canadian-grown tobacco and modern rolling/packaging lines.

Are Native Smokes Worse in Quality?

Do cheaper smokes mean they are lower in quality? The answer may be subjective.

Many Canadian smokers are used to smoking premium imports like Marlboro or DuMarier. These brands have been around for close to a century and benefit from the billions of dollars spent on R&D and manufacturing by Big Tobacco companies. The result is a classic and consistent cigarette that many have come to love and rely on.

Native smokes are about 70% cheaper than imports, but does that mean they are worse in quality? Not quite. Although native smokes haven’t been around for as long and aren’t funded by mega corporations, they are manufactured with Canadian preferences in mind, and some brands use high-quality domestic tobacco that is on par with what they use in higher-end regular brands.

Because Indigenous manufacturers are exempt from paying certain taxes, they can put the dollar back in the customer’s pockets or invest more in R&D. However, they do not benefit from the same manufacturing finesse that is only possible for larger-scale operations.

Today, the native smokes market is flourishing, as more Canadians find out about it. This has produced many winners that are exclusively native-made, some that come to mind include: Canadian cigarettes, Rolled Gold, BB cigarettes, and Canadian Goose. These brands are consistently compared to more non-native premium cigarette brands.

Why Are Native Smokes So Much Cheaper

If you’re comparing prices, the difference between regular retail cigarettes and native smokes can be substantial. Several factors explain that gap.

1. Taxation differences

For regular retail cigarettes, taxes make up most of the shelf price. You pay:

- Federal excise duty

- Provincial tobacco tax

- GST/HST/PST on top of those

Indigenous businesses operating on reserve may be exempt from some of these taxes, especially when selling to status First Nations customers on reserve. That tax relief is the single biggest reason native smokes are cheaper.

2. Lower overhead and independent distribution

Many Indigenous brands:

- Have leaner operations

- Use independent distribution instead of big corporate chains

- Spend less on national advertising

3. Unique regulatory environment

Indigenous communities negotiate their own arrangements and regulations around tobacco production and sale. The regulatory framework is different than mainstream commercial tobacco, which can affect how duties and taxes apply, especially for on-reserve transactions.

On-Reserve Native Smokes: The Cheapest Smokes In Person

If you live near a First Nations community, on-reserve smoke shops are often the cheapest place to buy smokes in person.

These can include:

- Band-run convenience stores

- Standalone smoke shacks

- Fuel stations with tobacco counters

How on-reserve pricing works

On many reserves:

- Cigarettes produced and sold on reserve may be sold with reduced or no provincial tobacco tax for eligible customers.

- That means the price you see on the carton is mostly tobacco + production + modest margin, rather than layers of tax.

However, there are important caveats:

- Rules vary by province and by status. In some provinces, non-status customers are not allowed to buy tax-exempt products at all.

- Local enforcement and licensing differ, and some off-reserve sales of untaxed cigarettes are explicitly illegal.

Always check what is allowed in your province before treating on-reserve shopping as a universal “hack.” An easier way to get access to native cigarettes without leaving your home is to buy cigarettes online from Cigarette Express. We ship discreetly in plain packaging and offer secure checkout with Interact e-transfer.

What to expect at an on-reserve smoke shop

Depending on the community, a typical visit might involve:

- A simple storefront with a wall of brands you won’t see in big-box stores: Mohawk, Canadian Goose, Sago, DK’s, Putters, Dumont, and more.

- Options for full flavour, light, menthol, king-size, and sometimes flavored or slim variants

- Cartons as the standard unit (individual packs are less common in some shops)

- Cash, debit, or e-Transfer; fewer places accept credit card terminals

Pros of buying on reserve:

- Often the very lowest price per pack or per carton

- Supports local Indigenous communities and employment

- Easy to stock up if you live nearby

Cons:

- Not everyone lives near a reserve

- Rules may limit what non-status buyers can legally purchase

- You must physically travel there, which isn’t practical for everyone

Online Native Smokes: Cheapest Smokes Delivered Across Canada

If you don’t live near a reserve, online Indigenous-owned smoke shops have become a major source of cheaper smokes. More of these have popped up in recent years. Online native smoke shops have become a great option for those who live in provinces where smokes are more expensive, or the weather conditions make it so that driving to a store is inconvenient.

These sites typically:

- Operate from tax-exempt Indigenous land

- Ship across Canada via Canada Post, UPS, Purolator, etc.

- Accept Interac e-Transfer or cryptocurrency as the primary payment method

- Emphasize that they’re Indigenous-owned and operated and that proceeds support First Nations communities

Why online native smokes are so popular

For many smokers, online native smokes offer a modern solution to their expensive habit. There are no restrictions on how many cartons you can buy – in fact, quite the opposite. Many Indigenous smoke shops will offer steeper discounts as you buy more cartons. The main factors why online native smokes have seen a surge in popularity:

- Price: Potential for significant savings because of tax exemption

- Convenience: Most retailers offer shipping through Canada Post, Purolater or UPS

- Variety: Plenty of native and Canadian brands to choose from

- Bulk rates: Many offer steeper discounts as you buy more

- Privacy: No need to show ID to purchase. Most retailers take E-transfer or cryptocurrency

As cigarette prices keep rising, online smoke shops present a golden opportunity to stave off inflation and tax increases by the government. With online shopping becoming more the norm, buying your cigarettes online just makes sense.

Cigarette Express: Cheapest Smokes Online, No Bulk Minimum

Within that online landscape, Cigarette Express occupies a specific niche:

- Cheapest smokes online (positioned to undercut most convenience-stores and native retailers online)

- No minimum bulk buy-in — you don’t need to commit to 5, 10, or 25 cartons to get fair pricing

This “no minimum bulk” structure is a greatly beneficial from a customer’s perspective:

- Many online native smoke shops structure their best prices around large-volume purchases (5+ or 10+ cartons), and sometimes even adjust shipping fees by volume.

- With Cigarette Express, you can order a single carton at a strong price, instead of being forced into a bigger cash outlay just to access “wholesale-style” savings.

When Cigarette Express makes the most sense

Cigarette Express is particularly attractive if:

- You’re price-sensitive but don’t want to order 10+ cartons at once

- You like trying different brands without committing to massive bulk. They have Mix and Match Deals for their bestselling brands, like Canadian.

- You want to hit the free shipping threshold at a much lower amount (most retailers do $299+, Cigarette Express is $199+)

How Much Can You Actually Save With Native Smokes?

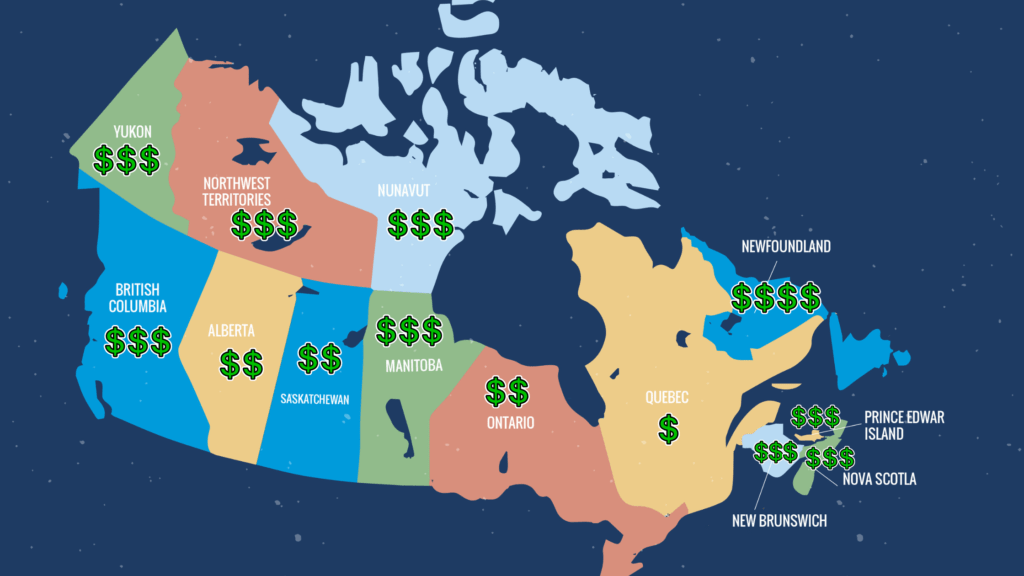

On average, you can expect to save at least 50% on cigarettes when you buy from a native smokes retailer (whether that be online/offline). Certain factors affect how much you save:

- Brands: Whether you’re comparing a native smokes brand to a premium or budget brand. You’ll save more if you’re used to smoking premium imports like Marlboro.

- Where you live: The cost of a cigarette pack depends on where you live. Each province has their own tax rate for cigarettes.

- Retailers: Costs will vary between different retailers.

- Habit: It’s most cost-effective for regular smokers

If you’re a regular smoker, you’re poised to save a significant amount by buying native smokes. The barrier for most people is actually driving onto the reserve, but with the rise of online smoke shops, this is no longer an issue. Regular smokers can save anywhere from hundreds to thousands of dollars a year by switching to native smokes.

Legal & Safety Considerations (Read This Part)

When you start researching “cheapest smokes in Canada,” you’ll quickly find a mix of:

- Legitimate, Indigenous-owned retailers

- Grey-area operations

- Outright contraband sellers

An independent report on contraband tobacco in BC, Ontario, and Newfoundland notes that some online “native brand” websites are operated off-reserve in violation of Canadian law, selling untaxed cigarettes across Canada without authorization.

Key legal points to keep in mind

- Native smokes are legal when produced, sold, and purchased in accordance with First Nations tax exemption laws and provincial tobacco regulations.

- It can be illegal to buy or possess untaxed cigarettes in some provinces if you are not entitled to the exemption, or if you buy from unlicensed or off-reserve sellers.

- Reselling native smokes off-reserve without proper licensing or tax remittance can expose you to fines, product seizures, and criminal charges.

How to spot a trustworthy online native smokes retailer

To reduce risk, look for:

- Clear indication that the business is Indigenous-owned and operating from reserve or tax-exempt land

- A real physical location, not just a PO box, plus valid contact details

- Transparent shipping policies, including realistic timelines and trackable shipping carriers

- Age verification and clear disclaimers about legal purchase and use

- Reasonable price ranges — deals that look impossibly cheap may be counterfeit or contraband

- Verified reviews from real customers

Cigarette Express is a retailer that is:

- 100% owned and operated on Indigenous territory

- Verifies age and complies with Canadian shipping rules

- Smooth checkout complete with Interact Etransfer

- Has real reviews via TrustPilot

- Ships through Canada Post or Purolater with tracking information

Are Native Smokes “Better” or “Safer”?

Native smokes are not healthier or safer to smoke than regular cigarettes. Native smokes still contain combustible tobacco, chemicals, nicotine and tar and carry the same risks of cancer, heart disease, stroke, COPD, and addiction as any other cigarette. The lower price is a function of tax policy and economics, not reduced harm. Cheaper native cigarettes should never be interpreted as a safer choice; they’re simply part of a different regulatory and economic framework.

In some cases, cheaper smokes may not be conducive to people trying to cut back on smoking for health reasons due to their affordability. If you are concerned about your health, the best savings will always come from cutting down or quitting entirely, not just switching brands.

Choosing the Right Native Smokes for You

If you’ve decided you’re going to buy native smokes, and you’re looking for the cheapest smokes in Canada, you still want something you enjoy smoking.

Here are some factors to consider:

1. Strength and profile

- Full flavour vs. light: Heavier throat hit and body versus smoother, milder smoke

- Menthol vs. regular: Cooling sensation vs. straight tobacco

- Filter type: Regular filter, charcoal filter, slim vs. king size

2. Brand reputation

Look for brands that are:

- Known for consistent burn and quality control

- Widely stocked across different Indigenous retailers

- Positively reviewed by other smokers (smoothness, burn rate, taste)

Many Indigenous brands now rival or surpass mainstream brands in terms of taste and smoothness, especially for smokers who prefer less chemical-tasting tobacco.

3. Buying format

- Single Packs – Best if you don’t want to commit to just one brand or occasional smokers

- Single cartons — Save more per pack

- Multi-carton orders — better per-carton pricing, especially with shops that offer tiered discounts or free shipping at certain thresholds

Again, this is where Cigarette Express can stand out: you don’t have to commit to huge bulk orders to access competitive pricing, which is ideal if you’re still figuring out your favourite native brand. Most cartons cost $34.99 flat.

Native Smokes Guide Recap: Where to Find the Cheapest Smokes in Canada

Finding cheap smokes in Canada isn’t hard– you just need to know where to look. If you’re reading this, you’re probably ahead of the game. To sum it up, your best bet of finding the cheapest smokes is through buying them on reserves or through online Indigenous smoke shops.

- On-reserve smoke shops

- Lowest in-person prices

- Best if you live close to a First Nations community and understand the local rules

- Directly supports Indigenous economies

- Lowest in-person prices

- Indigenous-owned online native smokes retailers

- Deliver across Canada, usually with tax-free or reduced-tax pricing

- Offer wide brand selection and bulk options

- Require careful vetting to avoid contraband or off-reserve illegal operations

- Deliver across Canada, usually with tax-free or reduced-tax pricing

- Cigarette Express

- Positioned as offering the cheapest smokes online

- No minimum bulk buy-in — strong pricing even if you only want a single carton

- Great option for smokers who want native/native-style smokes at aggressive prices without hanging hundreds of dollars on huge orders

- Positioned as offering the cheapest smokes online

- Duty-free & travel allowances

- May offer short-term savings for travellers, but is limited by quantity and strict rules

- Not a practical ongoing source for most smokers

- May offer short-term savings for travellers, but is limited by quantity and strict rules

Native smokes exist at the intersection of Indigenous rights, taxation policy, economics, and consumer demand. They’re cheaper not because they’re of lesser quality, but because they sit in a different legal and economic lane than heavily taxed mainstream brands. Despite the fact that native smokes are cheaper, it doesn’t mean they are any better or healthier for you than regular smokes. Smoking always carries health risks–so buy at your own risk! If you’re a regular smoker, buying smokes on reserve may be the cheapest option, but in terms of convenience and guarantee, you can save a hefty amount just by buying online. Check out Cigarette Express for the cheapest cartons online with no bulk minimum buy-ins!

Sources

Canada Revenue Agency. (2024). Excise duty rates—Tobacco products. Government of Canada. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/edrates.html

Government of Canada. (2024). Tobacco and Vaping Products Act. https://www.canada.ca/en/health-canada/services/smoking-tobacco.html

Government of Canada. (2024). Indian Act (R.S.C., 1985, c. I-5). https://laws-lois.justice.gc.ca/eng/acts/i-5/

Statistics Canada. (2024). Consumer Price Index: Tobacco products. https://www150.statcan.gc.ca

Non-Smokers’ Rights Association. (2023). Provincial and territorial tobacco tax rates in Canada. https://nsra-adnf.ca

Public Safety Canada. (2023). Contraband tobacco control strategy. https://www.publicsafety.gc.ca

First Nations Tax Commission. (2023). First Nations fiscal powers and tax jurisdiction. https://fntc.ca

Canadian Cancer Society. (2023). Tobacco taxation and health impacts. https://cancer.ca