If you’ve been wondering how much is a pack of cigarettes in Canada right now, you’re not alone. Cigarette prices have climbed steadily across all provinces over the past decade, driven largely by federal excise taxes, provincial tobacco taxes, and import duties. As of 2025, the average price of a standard, fully taxed pack of cigarettes in Canada is between $15 and $23, depending on where you live.

This comprehensive guide breaks down average cigarette prices by province, explains why some regions pay more than others, and covers how taxes, duties, and retail markup all contribute to the final cost. Whether you’re budgeting, comparing prices, or trying to understand how regulations shape the market, this article covers everything you need to know to be an informed shopper.

How Much Is a Pack of Cigarettes in Canada? (National Average)

Across Canada, the typical fully taxed cigarette prices are:

- $15–$21 for a 25-pack

- $12–$16 for a 20-pack

The national average sits around $17–$18 for a regular retail 25-pack. Prices vary widely due to provincial tobacco taxes, which are applied on top of federal excise duty and sales taxes.

It’s also normal to see a $6–$8 difference between the cheapest and most expensive provinces.

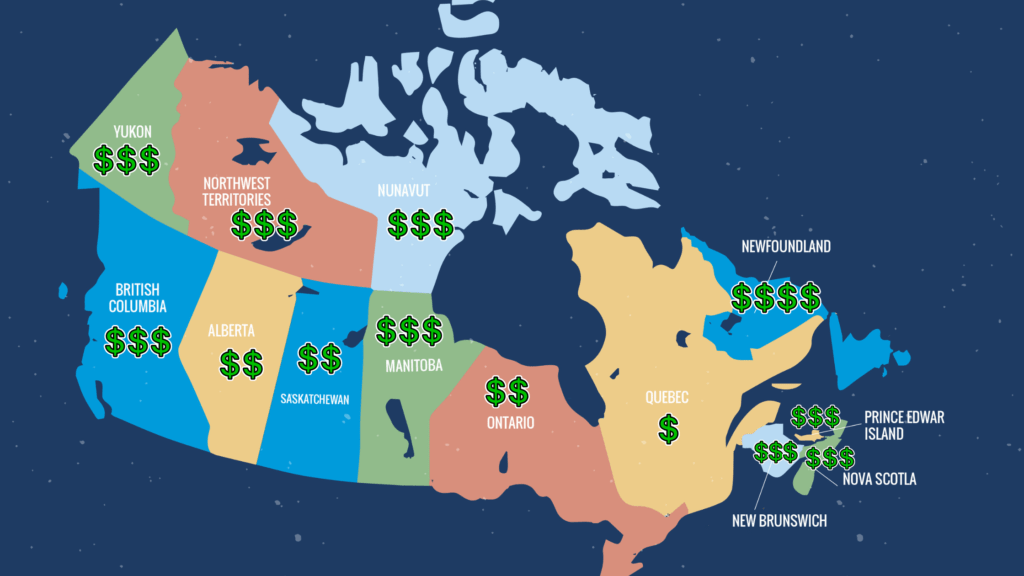

Average Cigarette Prices by Province (2025)

Below is an easy-to-read breakdown of how much a pack of cigarettes costs in every Canadian province and territory. These are typical prices for a fully taxed 25-pack purchased from a convenience store or gas station.

Western Canada

British Columbia (BC): $18–$20 per pack

BC has one of the highest provincial tobacco taxes, pushing retail cigarette prices close to the national top tier.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in BC at Cigarette Express and save on average, 75% or $15.

Alberta (AB): $14–$18 per pack

Alberta cigarettes are cheaper than in most provinces due to moderate tobacco tax rates and no provincial sales tax (PST).

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Alberta at Cigarette Express and save on average, 72% or $13.

Saskatchewan (SK): $16–$18 per pack

Saskatchewan sits in the middle range, with taxation slightly above Alberta but lower than Manitoba.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Saskatchewan at Cigarette Express and save on average, 72% or $13.

Manitoba (MB): $18–$20 per pack

High provincial tobacco taxes make Manitoba one of the pricier regions for smokers.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Manitoba at Cigarette Express and save on average, 75% or $15.

Central Canada

Ontario (ON): $15–$17 per pack

Ontario consistently offers mid-tier pricing, lower than Western and Atlantic provinces, and slightly higher than Quebec.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Ontario at Cigarette Express and save on average, 67% or $10.

Quebec (QC): $13–$15 per pack

Quebec is almost always the cheapest province in Canada for fully taxed cigarettes.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Quebec at Cigarette Express and save on average, 62% or $8.

Atlantic Canada

These provinces carry the highest tobacco taxes in the country.

Nova Scotia (NS): $19–$21 per pack

New Brunswick (NB): $18–$19 per pack

Prince Edward Island (PEI): $19–$20 per pack

Newfoundland & Labrador (NL): $21–$23 per pack

Newfoundland & Labrador holds the highest cigarette prices in Canada, driven by aggressive provincial taxation.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Newfoundland and Labrador at Cigarette Express and save on average, 78% or $18.

Territories

Yukon, Northwest Territories, Nunavut: $18–$21 per pack

Territorial prices are high due to tobacco taxes and increased freight costs for remote communities.

Want to save money on cigarettes? You’re in luck, buy cigarettes online in Yukon at Cigarette Express and save on average, 76% or $16.

Why Cigarette Prices Are So High in Canada

If you’re wondering why the heck a pack is so expensive, the short answer is: taxes make up more than 70% of the price of a Canadian cigarette pack.

Here’s what affects the final shelf price.

1. Federal Excise Duty

This is the biggest pricing factor and applies uniformly across Canada.

As of April 1, 2025, the federal excise duty is: $0.95391 per five cigarettes (~19 cents each)

This translates to:

- ~$3.80 in federal duty on a 20-pack

- ~$4.75–$4.80 on a 25-pack

The federal government also increases this duty annually, in line with inflation. Additional special one-time increases sometimes appear in federal budgets, adding more cost per carton.

2. Provincial Tobacco Taxes

This is where the biggest differences between provinces appear. Every province sets its own rate, and these taxes pile on top of the federal duty.

Here is what provincial taxes look like on average per carton of 200 cigarettes:

- Ontario: ~$37

- Quebec: ~$41.80

- Alberta: ~$40

- Saskatchewan: ~$45

- Manitoba: ~$59

- British Columbia: ~$55

- Nova Scotia: ~$60.04

- New Brunswick: ~$56.25

- Prince Edward Island: ~$58

- Newfoundland & Labrador: ~$68

- Territories: ~$55–$60

These taxes directly explain why Quebec smokes cost so much less than NL or NS.

Did you Know? A carton of 200 cigarettes bought online at Cigarette Express costs less than just the tax portion of a carton of cigarettes in any province. The lowest amount of provincial tax is in Ontario, which is $37 for every carton. You can buy a full carton of cigarettes for $34.99 with no tax, directly from Cigarette Express

3. Sales Taxes (GST, PST, HST)

After federal and provincial tobacco taxes are applied, Canadians still pay:

- GST (5%)

- HST (13–15%) in some provinces

- PST (6–10%) in provinces such as BC, Saskatchewan, and Manitoba

These taxes apply to the final retail price, which already includes tobacco taxes, meaning smokers pay tax on top of tax.

4. Retail Markup & Brand Premiums

When we think about what goes into the price of a pack, we often forget that retailers also need to make money from the sale.

Retailers such as convenience stores or smoke shops typically add a 10-15% markup on packs, which equates to about $1 to $2 a pack. Premium brands like Du Maurier or Marlboro can cost $1–$2 more per pack compared to budget brands.

Why Some Packs Are Cheaper (or More Expensive) Even Within the Same Province

Price differences inside each province come down to:

- Brand (premium vs. value)

- Retailer type (gas station vs. grocery store)

- Pack size (20 vs. 25)

- Local retail competition

- On-reserve vs. off-reserve taxation

Some Indigenous-owned retailers legally operate with different tax structures, which is why carton prices can be significantly lower compared to fully taxed convenience-store pricing. Cigarette Express is an online smoke shop that is 100% Indigenous owned and operated, meaning it does not need to follow the same tobacco tax structure as the rest of Canada. This means we can offer quality smokes for up to 75% cheaper. No taxes or import fees = Huge Savings for our Customers!

How Import Duties Affect the Price of Cigarettes

Imported cigarettes (non-domestic brands) can face:

- Additional excise duties

- Special duties

- Compliance requirements for stamping and packaging

For travelers bringing cigarettes into Canada, duty-free allowances apply only within limits. Beyond the exemption, federal excise, provincial tax, and special duties apply—often making foreign cigarettes more expensive than local brands. In Canadian airports, you’re only allowed 200 cigarettes duty-free before you’re subject to paying provincial taxes.

Why Cigarette Prices Keep Climbing Each Year

Gas, milk, and eggs aren’t the only consumables that keep getting pricier. Compared to what it was a decade ago, the price of cigarettes in Canada has shot up 50-100% over the past decade. It makes sense why more Canadians are finding it a habit that’s hard to justify. Vapes have increased in popularity, especially amongst Millennials and Gen Z, but they’re subject to the same taxes, and in many cases, aren’t a very affordable habit either. A myriad of factors contributed to the steady price hike of cigarettes and tobacco products:

1. Annual federal excise duty increases

Indexed to inflation, meaning prices rise even if nothing else changes.

2. Provincial tax adjustments

Often raised during provincial budgets for revenue and public-health goals.

3. Public health strategy

Higher cigarette prices strongly correlate with lower smoking rates, especially among youth.

4. Inflation and retailer costs

Everything from shipping to rent increases retail prices over time.

How Much Is a Pack of Cigarettes? (Cliffnotes Version)

If you want a fast, simple answer to the question “How much is a pack of cigarettes in Canada?”, here it is:

Canada-wide 2025 average:

- 20-pack: $12–$16

- 25-pack: $15–$23

Cheapest Province: Quebec

Most Expensive Province: Newfoundland & Labrador

Each province sets its own tax rate for tobacco products, which can contribute to a wide variance in the cost of a pack of cigarettes. Every 70 cents of a dollar for a cigarette pack is spent on taxes and duty fees.

Understanding How Much a Pack of Cigarettes Costs in Canada

Next time you’re comparing with a visitor on how much a pack of cigarettes costs, the accurate answer depends heavily on where in Canada they live.

While Canadians across the country deal with some of the highest cigarette prices in the world, the variation from $13 to more than $23 per pack is almost entirely due to tax policy, cost of distribution, and provincial legislation.

These prices will continue to rise as federal and provincial governments adjust tobacco taxes as part of ongoing public health and fiscal strategies.

As more Canadians learn about the benefits of buying cigarettes online from native smoke shops like Cigarette Express, don’t be one of the ones left behind on this life hack. Buying cigarettes online can take just a few minutes– and you’ll be saving hundreds, if not thousands, in the long run. Shop smarter, try it today at cigaretteepxress.ca